rsu tax rate calculator

This project aims to build an interactive web tool for creating necessary tax reports for the Finnish Tax Authorities Vero when receiving stock from RSU bonuses. If you live in a state where you need to pay state.

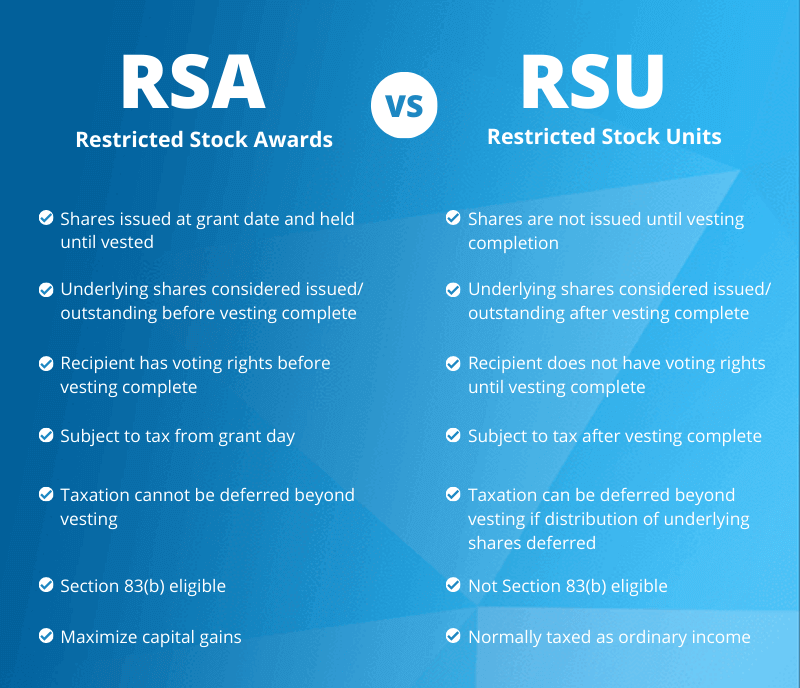

Rsa Vs Rsu What S The Difference Carta

The of shares vesting x price of shares Income taxed in the current year.

. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is. If your state does not have a special supplemental rate you will be. Get information about sales tax and how it impacts your existing business processes.

Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to. Quickly learn licenses that your business needs and. These calculators use supplemental tax rates to calculate withholdings on special wage payments such as bonuses.

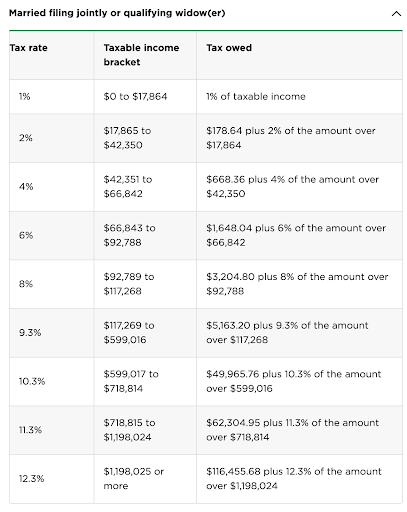

Your average tax rate is 1198 and your marginal. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. If you choose to hold.

For most people the tax rate on long-term. Apply more accurate rates to sales tax returns. California has among the highest taxes in the nation.

Input your current marginal tax rate on vesting RSUs. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Enter the amount of your new grant whether an offer grant or an annual refresh.

Decide on your strategy. If held beyond the vesting date the RSU tax when shares. If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate.

To use the RSU projection calculator walk through the following steps. California Income Tax Calculator 2021. Restricted stock units rsus tax calculator apr 23 2019 0 hope you had a chance to glance over at the official restricted stock unit rsu strategy.

RSU tax at vesting date is. If you make 70000 a year living in the region of California USA you will be taxed 15111. Long-term capital gains are taxed at a special lower rate.

Here is an article on rsu tax. For example if you are issued 10000 worth of RSUs as part of your compensation package you will pay ordinary income tax on 10000.

Rsu Calculator By David Twizer

How Is The Rsu Value Calculated Quora

Tax Basis And Stock Based Compensation Don T Get Taxed Twice

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

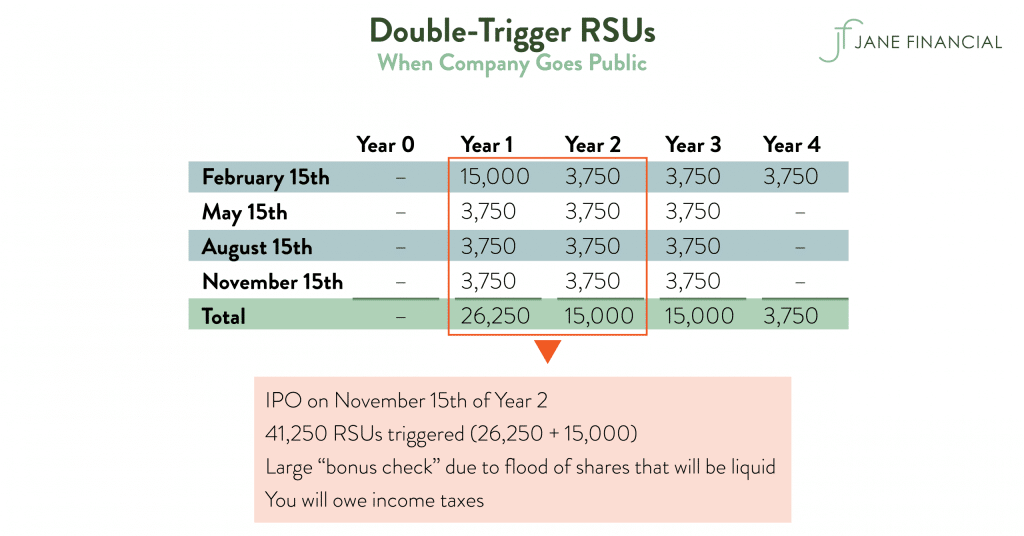

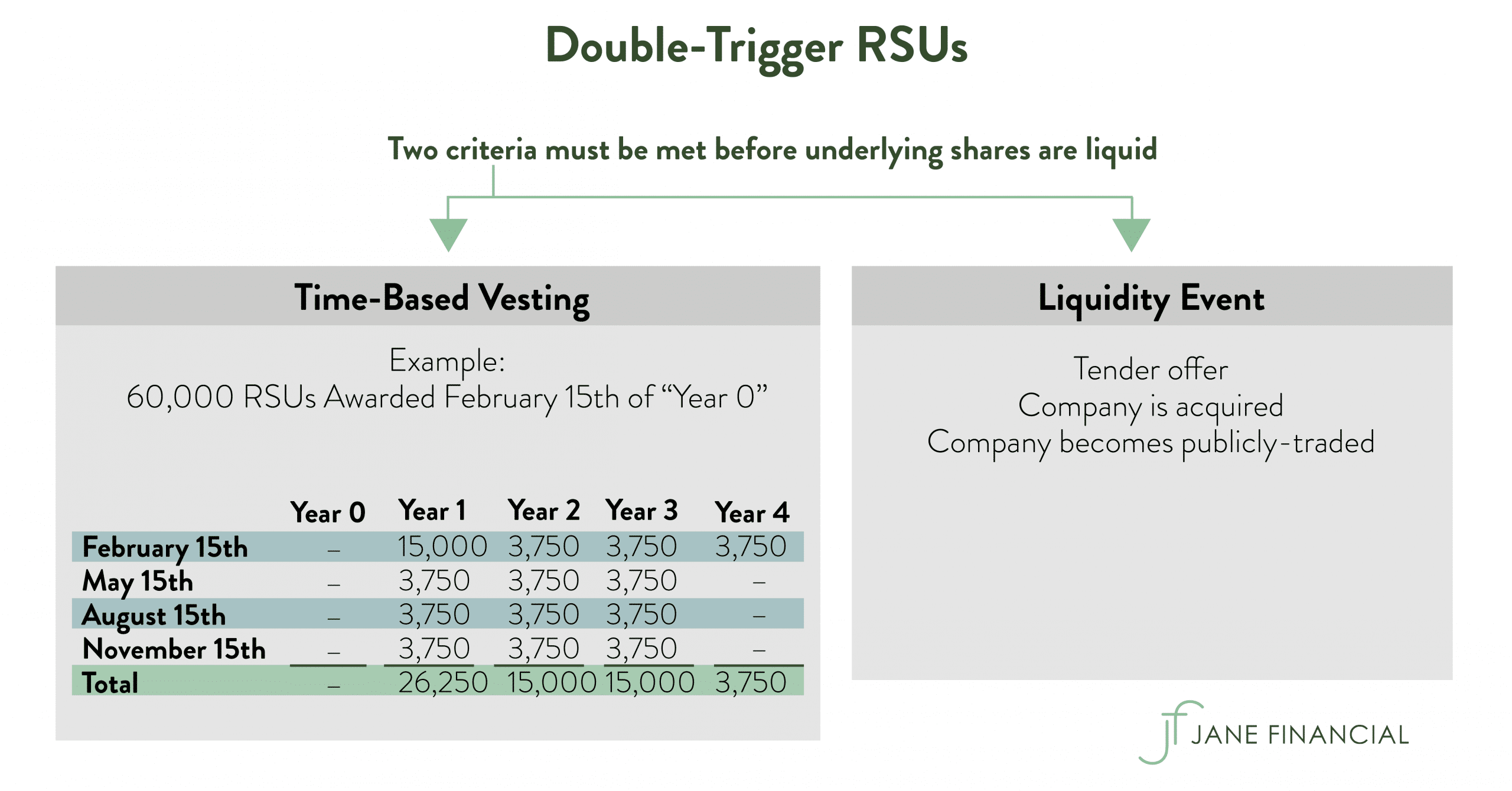

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

The Mystockoptions Blog Pre Ipo Companies

Rsu Of Mnc Perquisite Tax Capital Gains Itr

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

How To Calculate Iso Alternative Minimum Tax Amt 2021

Restricted Stock Units Rsus Comprehensive Guide Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Restricted Stock Units Jane Financial

When Should You Sell Rsu Shares Parkworth Wealth Management

Rsa Vs Rsu All You Need To Know Eqvista

![]()

Rsu Calculator By David Twizer

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management